CoServ Earns Fitch Ratings Upgrade

The interest rate is a critical part of any big purchase, whether it’s a house, a car or anything else that requires a loan. The better your credit score, the lower the interest rate and the lower your payment will be.

These factors are just as important for CoServ.

As a fast-growing co-op, CoServ relies on internally generated funds and loans to purchase infrastructure so we can continue Investing in Tomorrow for our Members. That includes buying transformers, poles and wire as well as bucket trucks, safety gear and other equipment.

The majority of CoServ loans are issued by insurance companies and private pension funds that want to invest in companies they can trust.

Investors rely on rating agencies like Fitch Ratings to conduct an in-depth, independent examination of a business’ financial health and outlook for the future.

In July, Fitch Ratings upgraded CoServ’s debt from an A+ to AA- bond rating. The bond rating, like a credit score for big companies, is determined by experts who rate debt for other electric utilities.

The upgrade “reflects CoServ’s strong and improved credit profile as an electric distribution cooperative serving a high-growth service area in the Dallas-Fort Worth metroplex,”

Fitch wrote in its report.

Fitch goes on to say that “rate affordability remains very strong.”

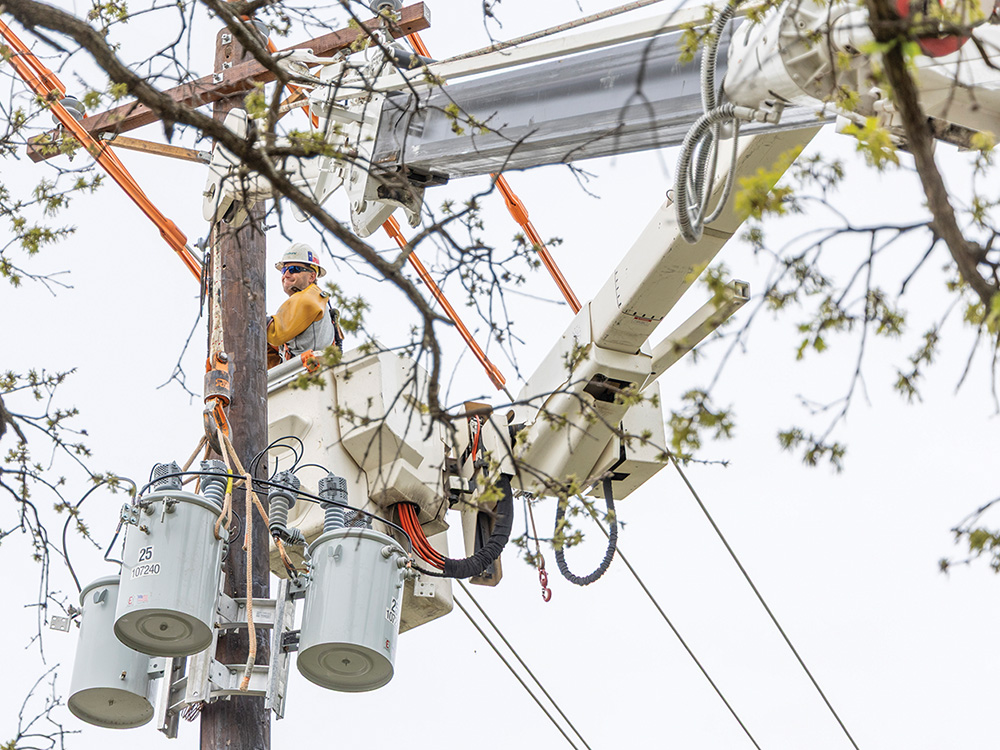

Linemen Installing new pole, transformer and underground service line.

What does this mean to Members?

As a not-for-profit cooperative, we are owned by our Members and governed by a democratically elected Board of Directors. We strive to be good stewards of the Members’ co-op.

This bond rating upgrade demonstrates our commitment to financial responsibility and our dedication to keep costs as low as possible for Members.

It will allow us to secure lower interest rates, which ultimately means better affordability. CoServ is the third-largest electric cooperative in the country and one of the few that issues private-debt.

CoServ surpassed 500,000 combined electric and gas meters last June and shows no signs of slowing down. In fact, CoServ could double that meter count in the next 10 to 15 years.

“This ratings upgrade is the result of a lot of key decisions from CoServ, with the end goal of providing affordable electric rates while also raising our profile to investors so we can continue borrowing for the future at the lowest cost,” CoServ’s Chief Financial Officer, Brent Bishop, said.

Fiscal responsibility is just another way that CoServ is Investing in Tomorrow. Thank you for allowing us to continue serving you with reliable, affordable electricity.